After years of escalating premiums and tight capacity, the cyber insurance landscape saw unexpected shifts in 2023. Softening market conditions brought relief to buyers, with rates stabilizing or even declining. This change was attributed to various factors, including reduced cyber claim frequency and severity in the latter half of 2022. Speculations on the causes ranged from geopolitical distractions to improved underwriting practices and enhanced cybersecurity measures among insureds.

The preceding year presented a tale of contrasting forces. While market conditions softened, cyber claim activity surged, particularly driven by ransomware attacks. Industries like healthcare, finance, technology, and government bore the brunt of these attacks. Moreover, wrongful data collection claims emerged as a significant threat, inviting regulatory scrutiny and enforcement actions.

Geopolitical tensions and the proliferation of artificial intelligence further complicated the cyber threat landscape, prompting discussions on systemic cyber risks. Despite these challenges, the market continued to soften, posing profitability challenges for insurers striving to retain market share.

Cyber Claims Trends and the 2024 Threat Landscape

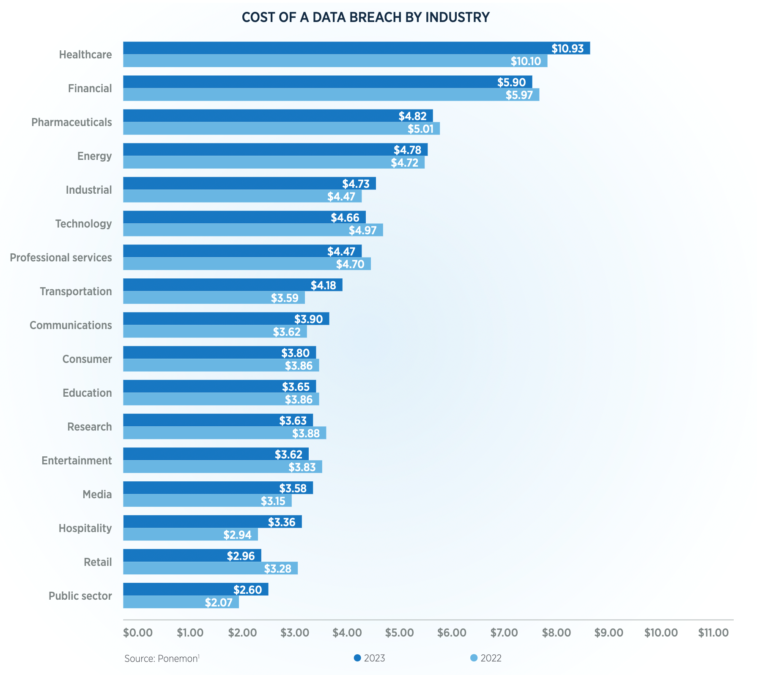

Ransomware attacks continued to evolve, with criminal groups adopting new tactics to evade law enforcement. Double extortion became commonplace, posing greater risks to organizations across all sectors. Reports from reputable sources underscored the increasing costs associated with data breaches, with healthcare, financial, and pharmaceutical industries bearing the highest costs.

Social engineering attacks, particularly Business Email Compromise (BEC) schemes, remained a significant concern, resulting in substantial financial losses. Heightened regulatory risk further compounded the challenges for businesses, especially with the introduction of new privacy laws and stringent reporting requirements by regulatory bodies like the SEC.

The US Federal Government Response

The Biden administration spearheaded several initiatives aimed at bolstering cybersecurity resilience. These efforts included launching the National Cybersecurity Strategy and forming alliances to combat ransomware. Additionally, executive orders focused on ensuring the safe and secure development and use of artificial intelligence, highlighting the government’s commitment to addressing emerging cyber threats.

Cyber Insurance Products Evolve

The evolving threat landscape necessitates continuous adaptation in cyber insurance products. Insurers are revising policy wordings to address emerging risks, such as war exclusions and regulatory coverage limitations. DOXA Cyber Insurance is playing a pivotal role in expanding capacity and leveraging advanced modeling tools to accurately assess cyber risks.

Where We Are Headed

The convergence of emerging technologies like artificial intelligence poses both opportunities and challenges for the cyber insurance market. Efforts to understand and mitigate new risks require collaboration among various stakeholders, including governments, regulators, insurers, and technology providers. As cyber threats continue to evolve, the cyber insurance market is poised for further growth, driven by innovation and risk mitigation efforts.

While challenges persist, the cyber insurance market has matured, equipped with valuable insights into cyber threats and effective risk mitigation strategies. Collaboration and innovation will be critical in navigating the complex cyber landscape and sustaining the market’s growth trajectory in 2024 and beyond.

If you have questions about Today’s News, or would like to learn more about DOXA’s tailored growth solutions, please contact us or call 888.747.3692.