The year 2024 is shaping up to be a significant one in the world of mergers and acquisitions (M&A). With January reporting impressive early numbers, the momentum only accelerated as February brought in additional noteworthy transactions. Let’s delve into the details of this promising start and what it means for the rest of the year.

In January, the U.S. witnessed 36 announced M&A transactions, setting the stage for a robust year ahead. However, the real surprise came in late February when nine additional deals were added to the January count, propelling it to the second-highest month of deal activity ever recorded, with a total of 36 deals. This unexpected surge is reminiscent of the bustling M&A landscape seen in 2022, rather than the comparatively subdued activity of 2023.

Traditionally, there’s a surge in M&A activity in December, carrying over into January. February tends to represent transactions initiated in the mid-late third quarter, with a gradual pick-up in activity as the year progresses. The year-to-date (YTD) numbers for 2024 are particularly encouraging, with 51 deals, marking the highest YTD deal count compared to the same period in 2022 and 2023.

One notable trend is the increasing dominance of private capital-backed buyers, accounting for 74% of the total transactions through February. Independent firms and public firms represent 22% and 4% of the total deals, respectively. While the share of public buyer acquisitions has decreased, largely due to the time-consuming nature of these deals, it’s expected to rebound as the year unfolds.

In terms of buyer concentration, ten buyers accounted for nearly half of all announced transactions, with the top three buyers—Focus Financial Partners, Summit Financial, and MAI Capital Management—comprising around 18% of the total deals.

Several noteworthy transactions in February further underscore the buoyant M&A environment. For instance, LPL Financial Holdings Inc. announced its major acquisition of Atria Wealth Solutions Inc., a wealth management holding company with approximately $100 billion in assets. This strategic move enhances Atria’s capabilities and competitiveness in the market, signaling a strong start for LPL in 2024.

Similarly, OneDigital Investment Advisors announced a strategic partnership with Wintrust Investments, acquiring Wintrust’s retirement division. This acquisition not only strengthens OneDigital’s presence in the Chicagoland market but also adds over $2.6 billion in retirement plan assets to its already substantial portfolio.

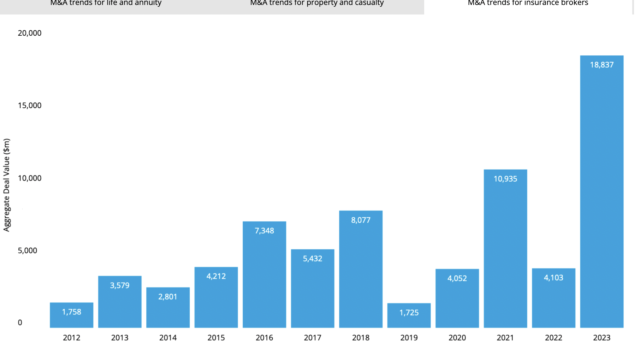

Looking ahead, optimism abounds for a potentially record-breaking year in M&A activity. Several economic factors, including the upcoming presidential election, expected interest rate stabilization, and the aging advisor population, contribute to this positive outlook. As DOXA continues to monitor these key factors and their impact on M&A activity, the stage is set for an exciting year of deals and transactions in 2024 and beyond.