As the United States braces itself for another presidential election, the implications stretch far beyond the political landscape and delve into the intricate world of mergers and acquisitions (M&A), particularly within the insurance brokerage sector. With President Biden and former President Trump vying for the nation’s highest office once again, the specter of potential policy changes looms large, influencing the strategic decisions of industry stakeholders.

In his recent State of the Union (SOTU) address, President Biden elucidated his tax plan, offering insights into his administration’s fiscal priorities. Among the proposed changes, significant adjustments targeting high earners and corporations were highlighted. Biden’s plan includes raising taxes on individuals earning over $400,000 annually and increasing the corporate tax rate to 28%. Furthermore, he aims to abolish tax breaks for executive pay exceeding $1 million, effectively altering the financial landscape for corporations.

While not explicitly mentioned in his address, the post-SOTU White House press statement unveiled intentions to double the capital gains tax to 39.6% for investors earning at least $1 million per annum. These proposals form a critical component of President Biden’s Fiscal Year 2025 budget, signaling potential upheavals in investment strategies and wealth management.

The prospect of a second term for President Biden could catalyze M&A activity in 2024, mirroring the trends witnessed in 2020/2021. Faced with looming tax alterations, business owners contemplating future sales may expedite their timelines, seeking to preemptively navigate the evolving tax landscape. The scenario echoes the rush observed in 2021 when a record number of firms opted for divestment amid apprehensions surrounding federal capital gains tax escalations.

Presently, firm owners are vigilantly monitoring the political rhetoric of the 2024 candidates, cognizant of the ramifications any tax modifications may have on their businesses’ valuation and personal financial gains. The potential doubling of capital gains tax rates looms as a formidable determinant of net proceeds, compelling stakeholders to assess their exposure diligently.

As the political arena evolves leading up to November, industry stalwarts like DOXA remain attuned to market dynamics and industry trends, facilitating informed decision-making for both buyers and sellers. The interplay between political maneuvers and market forces underscores the need for strategic foresight and adaptability within the brokerage landscape.

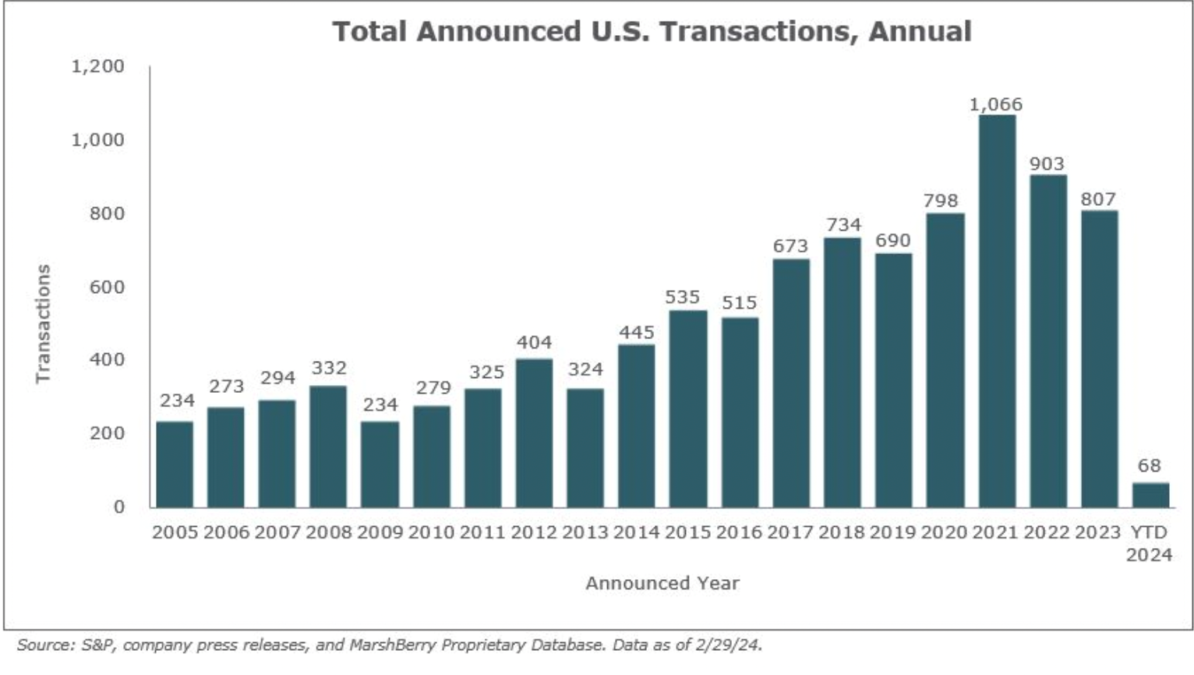

Providing a snapshot of the M&A market, data up to February 29, 2024, reveals 68 announced transactions in the United States, reflecting a notable uptick compared to the corresponding period in 2023.

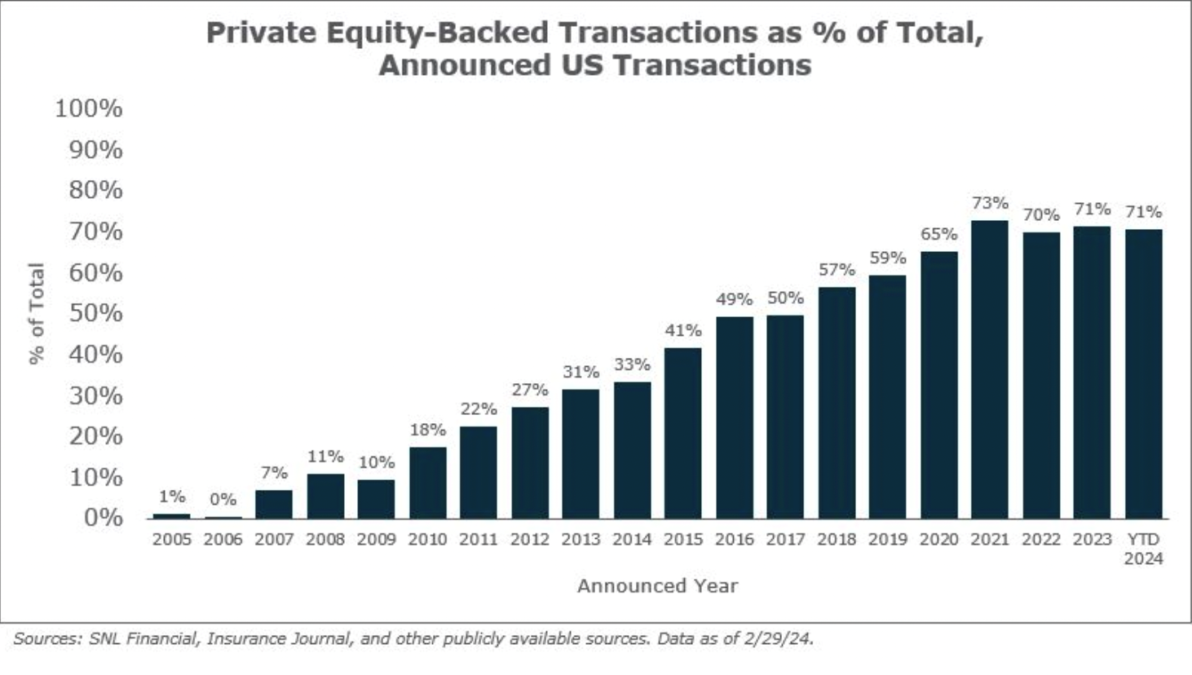

Private capital-backed buyers continue to dominate, accounting for 70.6% of transactions, consistent with historical trends. However, independent agency acquisitions witnessed a marginal decline, comprising 13.2% of the market share.

Of the key players driving M&A activity, ten buyers collectively orchestrated 66.2% of announced transactions, with entities like BroadStreet Partners, Inszone Insurance, and Arthur J. Gallagher leading the charge. Noteworthy transactions in February include Arthur J. Gallagher’s acquisition of The John Galt Insurance Agency, enhancing its foothold in Florida’s real estate niche, and Marsh McLennan Agency’s expansion in Louisiana through the acquisition of Querbes & Nelson and Louisiana Companies.

Truist Financial Corporation’s divestment of its remaining interest in Truist Insurance Holdings to an investor consortium marks a significant milestone, underlining the strategic recalibration within the financial services domain.

The impending presidential election casts a shadow of uncertainty over the insurance brokerage M&A landscape, compelling stakeholders to navigate the confluence of political rhetoric and market dynamics with prudence. As industry players brace for potential tax reforms and regulatory shifts, strategic agility and proactive engagement emerge as indispensable assets in the pursuit of sustainable growth and value creation amidst an ever-evolving landscape.

If you have questions about Today’s News, or would like to learn more about DOXA’s tailored growth solutions, please contact us or call 888.747.3692.