Early into 2024, the US property and casualty (P&C) insurance industry is riding on a wave of robust momentum. After facing profitability challenges in the previous year, marked by lower than desired returns, the industry has bounced back with vigor. Factors such as strong premium increases, easing claims cost inflation, and higher investment returns have contributed to a turnaround, setting the stage for continued growth and improved profitability in the coming years.

Profitability on the Rise

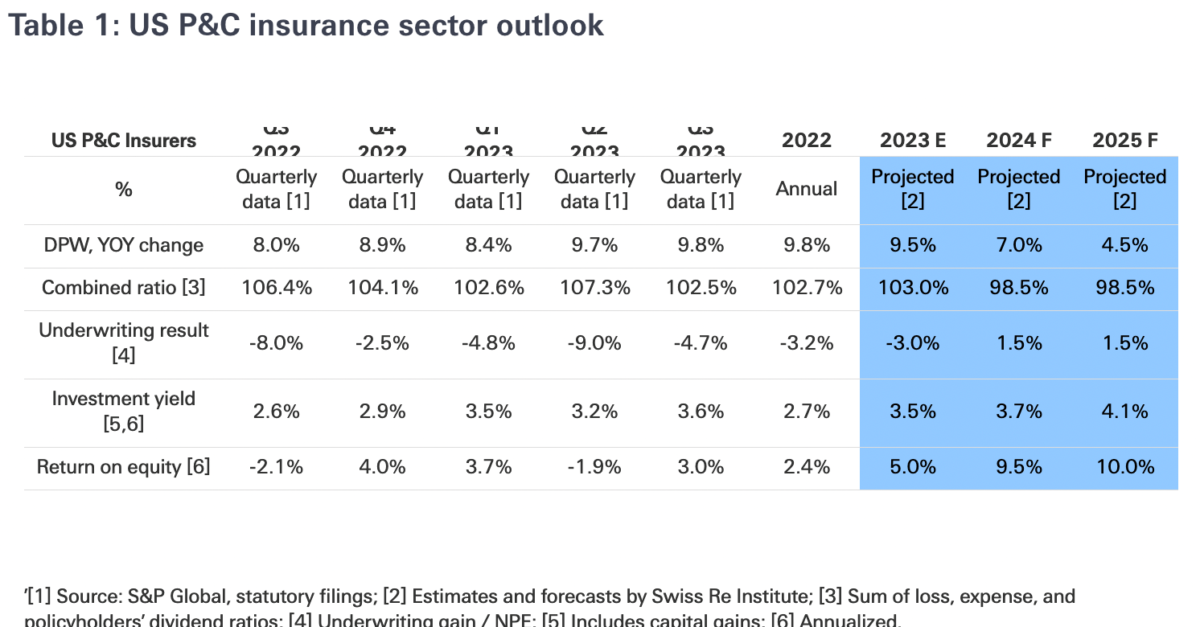

One of the key indicators of the industry’s resurgence is the expected rise in return on equity (ROE). After a somewhat lackluster performance in 2023, with an estimated ROE of 5.0%, we anticipate a significant improvement in 2024 and 2025. Our forecast pegs the industry ROE at 9.5% for 2024 and 10.0% for 2025, indicating a positive trajectory. Despite challenges such as persistent inflation and elevated insured losses from severe convective storms, the industry has shown resilience. Underwriting losses totaling USD 33 billion in the first nine months of 2023 were offset by higher net investment income, highlighting the industry’s ability to adapt and thrive amidst adversity.

Underwriting Improvement

A key driver of the anticipated improvement in profitability is the expected enhancement in the combined ratio, led by the personal auto segment. We project the industry net combined ratio to reach 98.5% in both 2024 and 2025, a significant improvement from an estimated 103% in 2023. While personal lines are expected to drive positive outcomes, commercial lines may face margin pressures, albeit from a position of relative strength. Despite challenges such as natural catastrophe losses and persistent inflation, the industry has demonstrated resilience, with improvement already evident in statutory data.

Growth Trajectory

Personal lines are anticipated to be the primary growth driver in 2024, fueled by strong premium increases in segments such as personal auto and homeowners’ insurance. In contrast, commercial lines growth rates are expected to moderate, with property lines outpacing liability lines. We forecast total direct premiums written (DPW) to grow by 7.0% in 2024, a revision from our earlier estimate of 5.5%, indicating a more optimistic outlook. This growth momentum is expected to continue into 2025, albeit at a slightly slower pace.

Pricing Dynamics

The pricing dynamics in the commercial property and liability segments are divergent. While commercial property rates are expected to witness strong growth rates in the high single digits, liability rate growth is anticipated to be more subdued, in the low single digits. Within liability lines, certain segments such as Directors & Officers (D&O) and cyber insurance have experienced rapid rate increases in recent years, although this trend is expected to moderate going forward.

Claims Costs and Investment Income

Claims costs are likely to decelerate in line with disinflation, with varying impacts across different lines of business. Property lines are expected to benefit the most from disinflation, with construction prices stabilizing after a period of significant increases. Conversely, liability lines may receive less benefit from economic disinflation, given the nature of claims and other factors such as social inflation.

Investment income is expected to rise, driven by higher investment yields and recurring income. Despite recent declines in long-term interest rates, we anticipate reinvestment yields to remain above average, supporting overall investment performance. Higher realized capital gains are also expected to contribute positively to investment results in the coming years.

The US property and casualty insurance industry is poised for continued growth and profitability in 2024 and beyond. Despite challenges such as inflation and natural catastrophes, the industry has demonstrated resilience and adaptability, positioning itself for success in a dynamic market landscape. With a focus on strategic planning, underwriting improvement, and innovation, insurers are well-equipped to navigate the opportunities and challenges that lie ahead.